ETH Price Prediction: Technical Weakness Meets Regulatory Crosscurrents

#ETH

- Technical indicators show bearish momentum with price below key moving averages

- Regulatory developments create mixed sentiment across different regions

- Bollinger Band positioning suggests potential for near-term support around $4,162

ETH Price Prediction

ETH Technical Analysis: Bearish Signals Dominate Short-Term Outlook

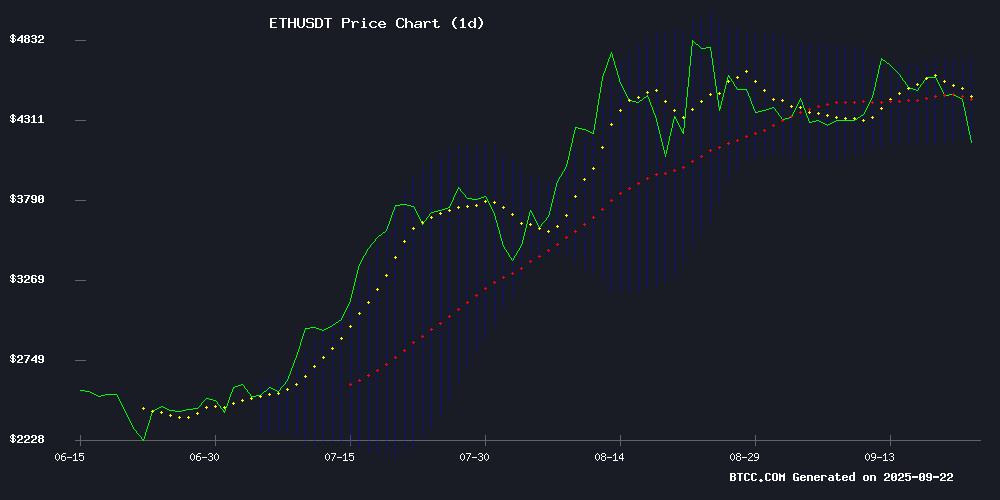

ETH is currently trading at $4,204.55, significantly below its 20-day moving average of $4,442.22, indicating bearish momentum. The MACD reading of -75.08 shows strong downward pressure, while the price sitting NEAR the lower Bollinger Band at $4,162.03 suggests potential oversold conditions. According to BTCC financial analyst John, 'The technical picture points to continued weakness in the near term, though proximity to the lower Bollinger Band may offer some support.'

Regulatory Developments Create Mixed Sentiment for Ethereum

The emergence of a stablecoin cold war and regulatory clashes over Layer-2 sequencers create uncertainty, while China's regulatory clarity provides some positive momentum. BTCC financial analyst John notes, 'The regulatory environment remains the key driver for ETH, with positive developments in China potentially offsetting Western regulatory challenges.' This aligns with the technical outlook suggesting cautious short-term sentiment.

Factors Influencing ETH's Price

East vs West Stablecoin Cold War Emerges in Battle for Trillion-Dollar Market

A geopolitical divide is forming in the stablecoin arena as MetaMask’s mUSD, the EU’s digital euro, and Hong Kong’s AxCNH vie for dominance in cross-border settlements. The prize isn’t speculative trading volume but the $2-4 trillion annual opportunity from just 1-2% migration of global payments to blockchain rails.

The US dollar holds structural advantages with mUSD’s seamless integration into MetaMask wallets and Stripe’s fiat bridges. Launched in September 2025, the solution combines issuance, spending, and ramps within a single interface—compressing settlement layers without new infrastructure.

Regulatory clarity gives Western initiatives an edge, with the 2025 GENIUS Act providing a federal framework. Meanwhile, IMF data suggests tokenized payments could capture hundreds of trillions in addressable volume, making even marginal adoption transformative within 12-24 months.

Regulatory Clash Over Layer-2 Sequencers Intensifies as Industry Challenges SEC Stance

Coinbase's chief legal officer Paul Grewal and Base founder Jesse Pollak have positioned Layer-2 sequencers as infrastructure rather than exchanges, directly contradicting regulatory warnings from SEC Commissioner Hester Peirce. The debate centers on whether these systems should face exchange registration requirements.

Grewal's Sept. 22 analogy compared Base's sequencer to Amazon Web Services, framing L2s as deterministic infrastructure that processes transactions without order matching. "They batch transactions while deferring order interaction rules to application-level smart contracts," he argued, drawing a clear technical distinction from traditional exchange functions.

Pollak provided granular technical details, explaining that Base's sequencer operates on a first-in/first-out basis before batching transactions to Ethereum. "The critical difference lies in execution mechanics," he noted. "Matching occurs within smart contracts—the sequencer merely orders transactions without controlling trade logic or pair matching."

This infrastructure argument gains weight from Base's design allowing Ethereum-direct transactions that bypass the sequencer entirely, preserving decentralization. The technical nuance could prove pivotal as regulators grapple with classifying rapidly evolving blockchain architectures.

China's Regulatory Clarity Bolsters Ethereum Amid Validator Exit Delays

Ethereum's proof-of-stake network faces unprecedented strain as 2.5 million ETH ($11.25 billion) remains locked in withdrawal queues. Exit times have ballooned to 46 days, squeezing liquidity for DeFi protocols dependent on staked ETH derivatives. The congestion follows ETH's 160% rally since April, triggering validator churn and profit-taking.

Structural constraints exacerbate the bottleneck. Ethereum's current design limits withdrawals to 256 ETH per epoch, creating parallel queues for activation and exits. Market analysts caution that prolonged delays could destabilize liquidity without alternative capital inflows.

China emerges as a stabilizing counterweight. Regulatory clarity from Hong Kong and Singapore has institutionalized ETH staking, with Asian hubs offering compliant frameworks for digital asset innovation. The U.S. SEC's May 2025 guidance—exempting PoS rewards from securities laws—further legitimized institutional participation.

This regulatory scaffolding helps mitigate Ethereum's technical growing pains. As validator queues lengthen, Asia's structured approach to tokenized assets and DeFi development provides critical market ballast.

Is ETH a good investment?

Based on current technical indicators and market developments, ETH presents a mixed investment case. The technical analysis shows clear bearish signals with the price below key moving averages and negative MACD momentum. However, the proximity to the lower Bollinger Band suggests potential for a technical bounce.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $4,204.55 | Below 20-day MA |

| 20-day MA | $4,442.22 | Resistance level |

| MACD | -75.08 | Bearish momentum |

| Bollinger Lower Band | $4,162.03 | Potential support |

From a fundamental perspective, regulatory developments create both opportunities and risks. While China's clearer regulatory framework supports Ethereum's long-term adoption, Western regulatory challenges could create headwinds. Investors should consider their risk tolerance and time horizon when evaluating ETH positions.